Electric Car Benefit In Kind 2025/24. The 2025/25 tax year multiplier for car fuel benefit is £27,800. The 2025/24 bik rates are the.

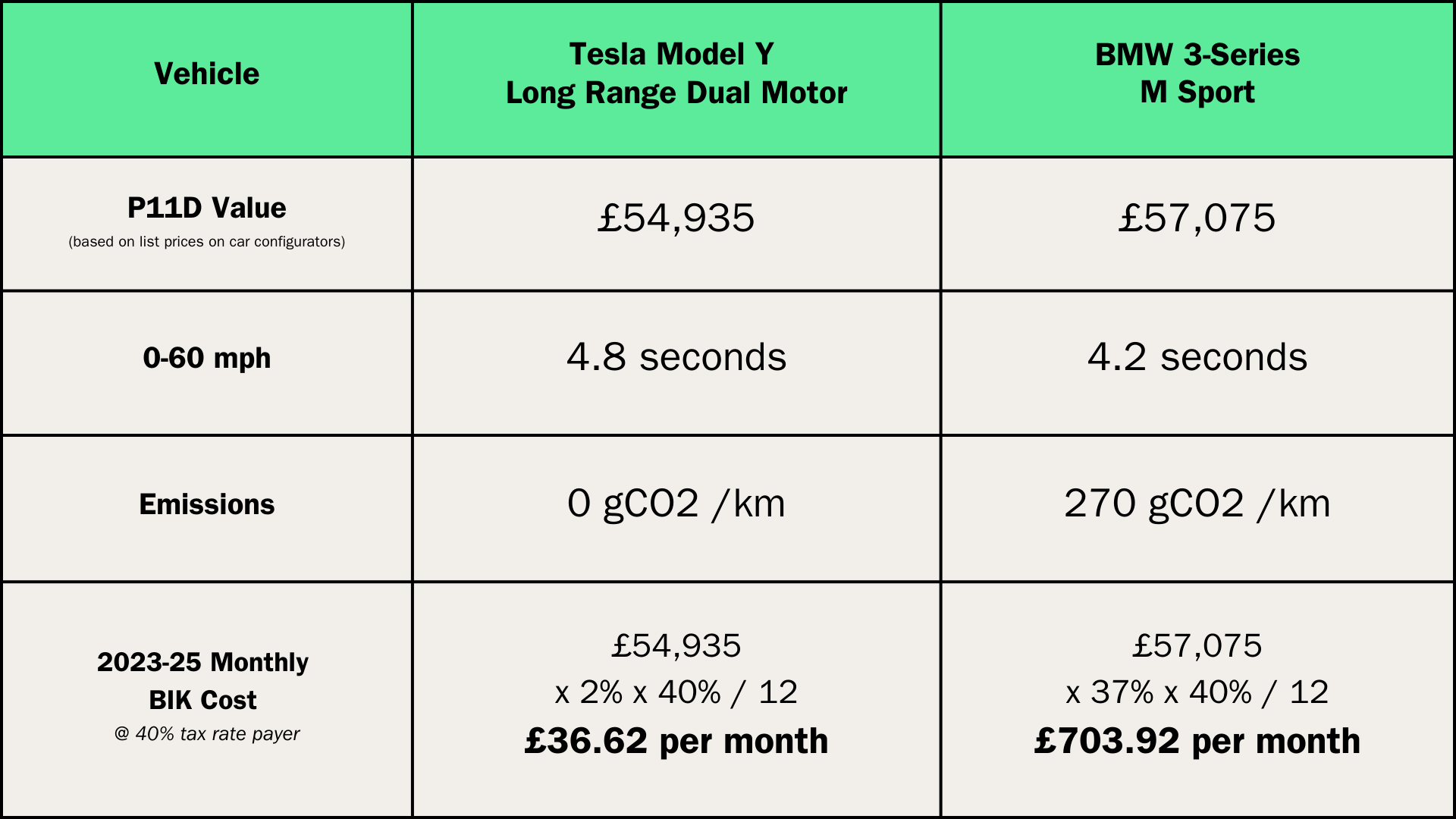

The present bik rate for electric cars is 2%, and it will remain at 2% for the 2025/24, and 2025/25 financial years. Benefit in kind (bik) rates have been frozen since 2025/23 tax year.

Electric cars the way for a sustainable automotive industry, as of 2025, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage.

The Ultimate Guide to Electric Car Benefit in Kind We Power Your Car, For all fully electric cars on sale, the bik rate is just 2% during the 2025/23 tax year at which it will remain during 2025/24 and 2025/25 (see table below). Electric cars the way for a sustainable automotive industry, as of 2025, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage.

Electric Car Benefit in Kind (BiK) Salary Sacrifice Guide — The, This is usually calculated during payroll. If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax.

Electric Car Benefit in Kind (BiK) Salary Sacrifice Guide — The, For comparison, petrol and diesel cars are. Then in the 2025/23 tax year it went up to 2% and it has remained that way until now.

Electric Car Benefit in Kind (BiK) Salary Sacrifice Guide — The, In the uk, corporate car tax (benefit in kind) is being waived on electric cars: The government currently have the bik rate set at 2% of the vehicle value for the 2025/23 tax year for electric cars as they produce 0 g/km of co2.

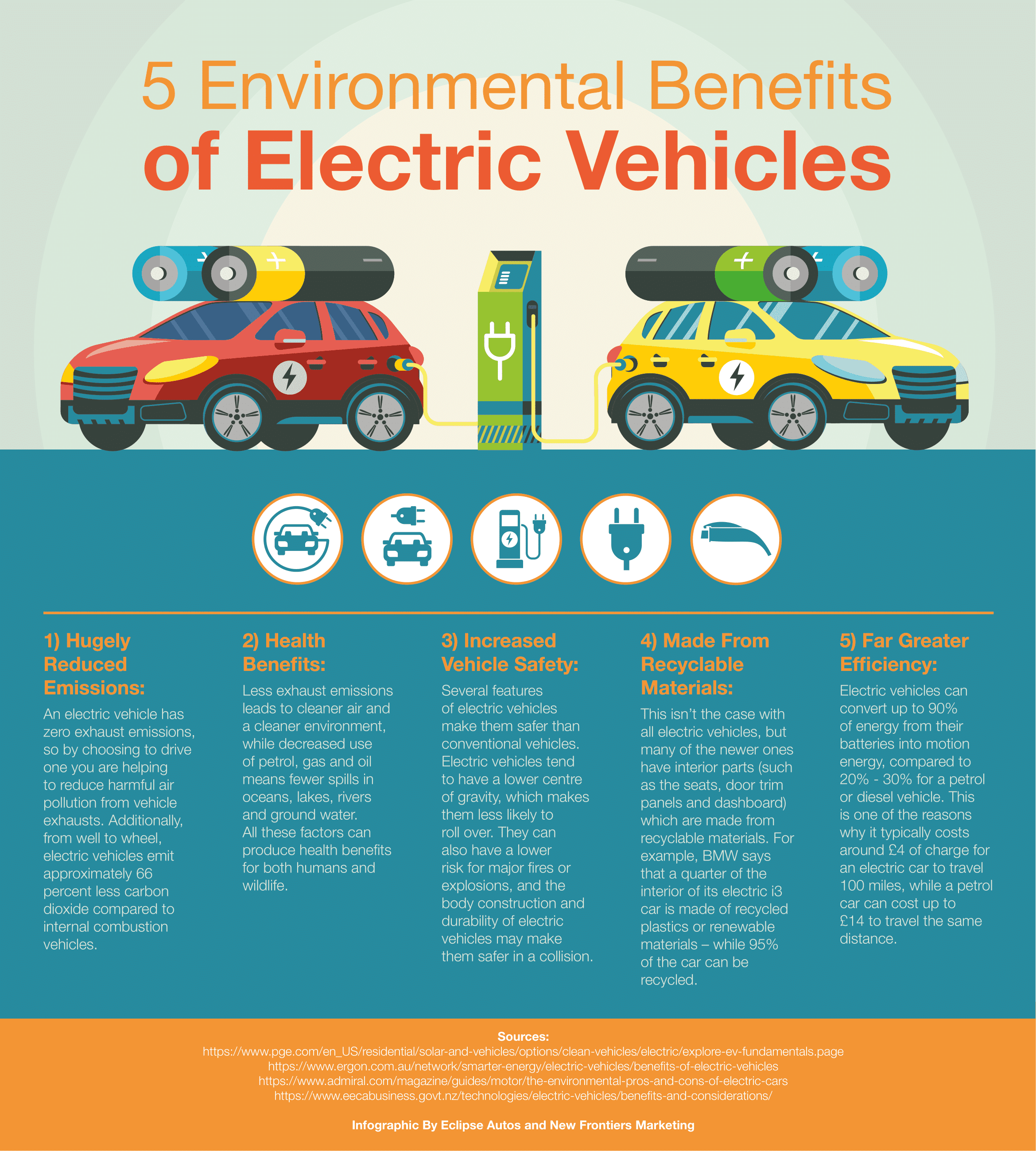

Infographic 5 Environmental Benefits of Electric Vehicles Eclipse Auto, Electric cars the way for a sustainable automotive industry, as of 2025, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage. For all fully electric cars on sale, the bik rate is just 2% during the 2025/23 tax year at which it will remain during 2025/24 and 2025/25 (see table below).

Electric Cars and Benefit in Kind tax FAQs GreenCarGuide, Electric cars favourable benefit in kind rates. The vehicle is fully electric;

Best Things About Electric Cars CleanTechnica, Then in the 2025/23 tax year it went up to 2% and it has remained that way until now. For all fully electric cars on sale, the bik rate is just 2% during the 2025/23 tax year at which it will remain during 2025/24 and 2025/25 (see table below).

Electric Cars The Way For A Sustainable Automotive Industry, This is usually calculated during payroll. After this time it will rise by 1% in the following three years (ie in 2025/26 it will be 3%;

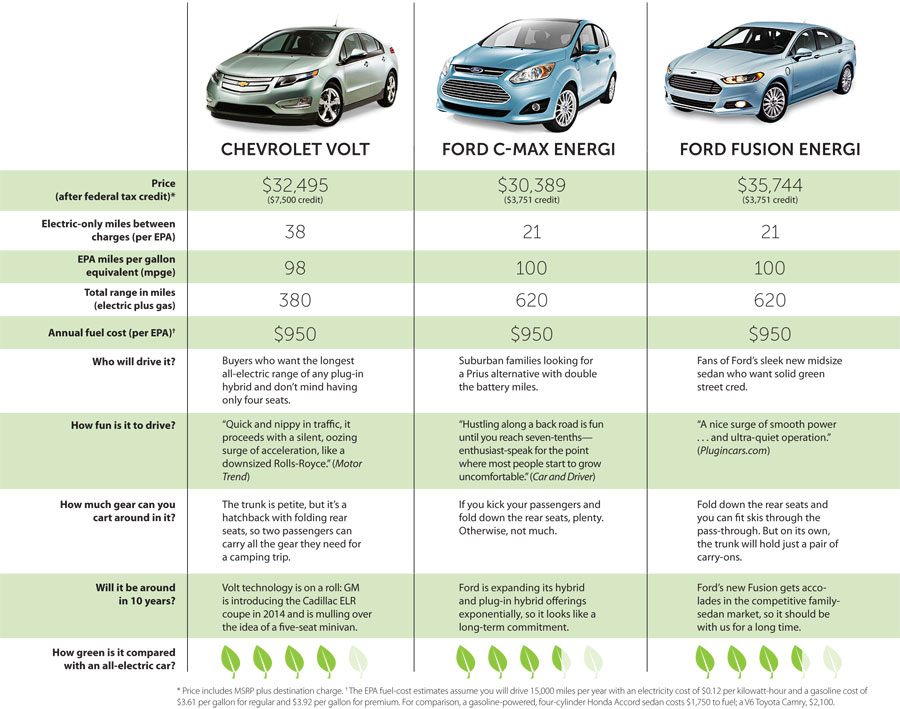

2025 Plug In Hybrid Electric Vehicle Comparison Darcee Oralia, Electric cars the way for a sustainable automotive industry, as of 2025, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage. This employee will receive an electric vehicle for the 2025/25 tax year.

Electric Cars Advantages and Disadvantages Infographic Stock Vector, In 2026/27 it will be 4%; The cash equivalent figures reported on each employee’s p11d are £150 health care and £3,000 car benefit.