Texas Franchise Tax Threshold 2025. On average, residents in texas pay 7.68% of their income in state and local taxes, compared to the us's average state tax burden of 11.41%, as of 2025. The deadline for filing your texas franchise tax return with the texas comptroller’s office is wednesday, may 15, 2025.

The taxable entities formed or doing business in texas are no. Moreover, taxpayers below the new threshold are no longer required to file a no tax due report.

Texas has increased the “no tax due” revenue threshold for the texas franchise tax to $2.47 million and eliminated the requirement to file a no tax due.

On average, residents in texas pay 7.68% of their income in state and local taxes, compared to the us’s average state tax burden of 11.41%, as of 2025.

How To Calculate Revenue For Texas Franchise Tax, No tax due threshold has increased to 2.47 million for reports due on or after january 1, 2025. Texas has increased the “no tax due” revenue threshold for the texas franchise tax to $2.47 million and eliminated the requirement to file a no tax due.

2025 Texas Franchise Tax Reporting Changes BSH Accounting, Texas has made several changes that apply to report year 2025 (calendar year 2025) increasing the “no tax due” revenue. 2025 changes to texas franchise tax filings:

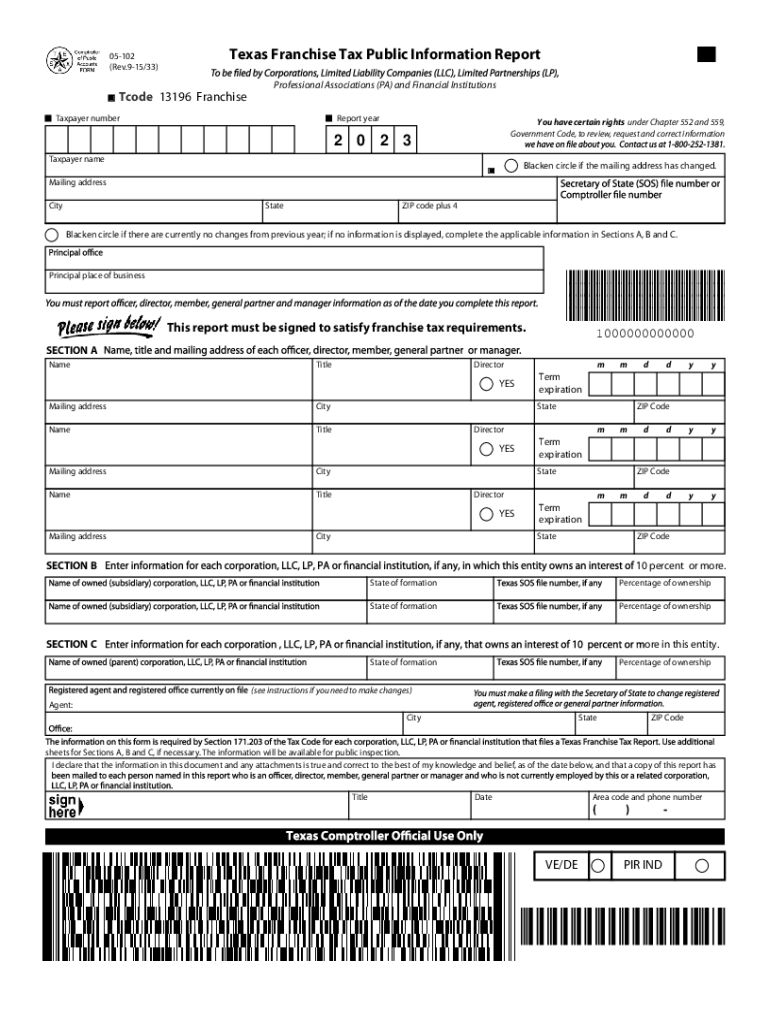

Franchise Tax Texas Report 20222024 Form Fill Out and Sign Printable, Tennessee governor bill lee signed into law sb 2103/hb 1893 on may 10, 2025, which significantly changes the tennessee franchise tax calculation by. Tax rates, thresholds and deduction limits.

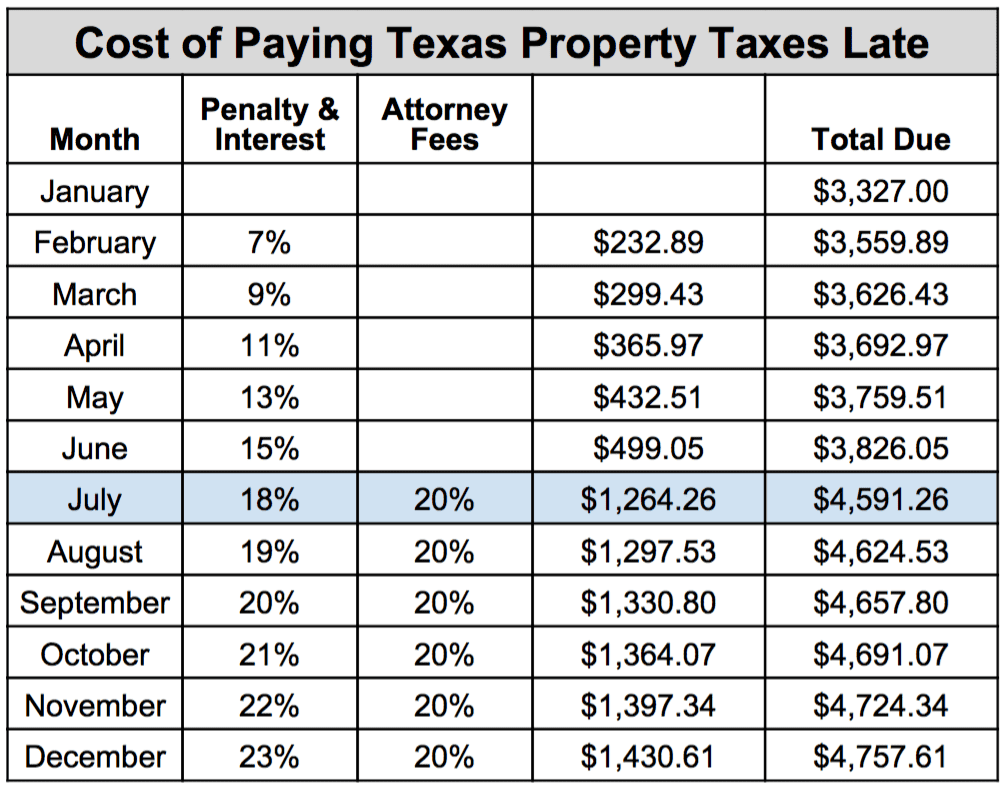

Texas Cost Estimate of Legislation Shows Impact of Franchise Tax Cut by, The deadline for filing your texas franchise tax return with the texas comptroller’s office is wednesday, may 15, 2025. Reports that are due on or after january 1 st ,2025 and are below.

Top Issues For The Texas Franchise Tax Reports C. Brian Streig, CPA, The deadline for filing your texas franchise tax return with the texas comptroller’s office is wednesday, may 15, 2025. The base state sales tax rate in.

How To File Franchise Tax Report For State Of Texas, Texas has increased the “no tax due” revenue threshold for the texas franchise tax to $2.47 million and eliminated the requirement to file a no tax due. One notable adjustment is the increase in the no tax due threshold to $2.47 million, effective for reports due on or after january 1, 2025.

How to Calculate Texas Franchise Tax The Tech Edvocate, There is only a tba on the page, but i need to advise our clients about what day. The base state sales tax rate in.

How To Fill Out Texas Franchise Tax Report, A minimum $800 annual franchise tax fee, except the first year of operation. Changes to texas franchise no tax due reports for 2025 | thekfordgroup.

The Disregarded Entity A Guide To Franchise Taxes In Texas, Effective for reports originally due on or after january 1, 2025, l. Based on each entity’s entire business.

Texas Franchise Tax 2025 2025, The deadline for filing your texas franchise tax return with the texas comptroller’s office is wednesday, may 15, 2025. 2025, s3 (2nd s.s.) increases the no tax due revenue threshold to $2.47 million.

The texas franchise tax is calculated on a company’s margin for all entities with revenues above $1,230,000.